Prior to 1980, the norm among park and recreation agencies was to give a “half price for children” discount to all those under 18, in essence, through high school. Subsequent pressures to generate more revenue have meant that these parameters survive in relatively few jurisdictions today.

Prior to 1980, the norm among park and recreation agencies was to give a “half price for children” discount to all those under 18, in essence, through high school. Subsequent pressures to generate more revenue have meant that these parameters survive in relatively few jurisdictions today.

Their erosion follows the aggressive actions of commercially themed parks and waterparks, which typically limit free admissions to those under 3; give 10 percent discounts to children aged 3 to 8 or 10; and charge full adult price for all those older than age 8 or 10. Their actions have made it easier for public park and recreation agencies to reduce the eligibility age and discount amount, because they have changed the reference price expectancy of many.

Ironically, the demise of youth discounts has coincided with a substantial deterioration in the economic status of youth. In 2011, 18.5 percent of young people under the age of 18 — about 13.5 million individuals — lived in households with incomes below the federal poverty level. The family is the chief source of their support, followed by government programs such as education and welfare. The deteriorating economic status of children reflects both an erosion of support from within the family and a lack of political support for government expenditures on them.

The Impact of Single-Parent Families

In the past half-century, an earthquake has shaken the family structure and fractured it. The deterioration of children’s economic well-being has been a consequence of this. In 1960, only nine percent of children were living with a single parent, but by 2012, this number increased to 29 percent. A large majority of these households are headed by women, and a substantial proportion of fathers accept little or no enduring responsibility for those children.

An increase in the number of single-parent families primarily reflects dramatic growth in the proportion of children born to nonmarried parents. When the War on Poverty was launched in the 1960s, only six percent of U.S. children were born out of wedlock, but by 2010 this had increased to almost 41 percent of all births. Further, among those children born to married couples, some will experience parental separation through divorce, which exacerbates children’s economic challenges. Divorce rates have remained consistent during the past four decades. The probability that a first marriage will end in divorce before the 10th wedding anniversary is 30 percent for men and 32 percent for women. This increases to 44 percent and 48 percent, respectively, by the 20th anniversary.

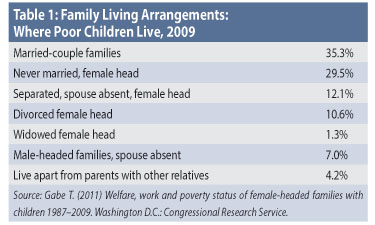

The negative relationship between single-family homes and child poverty is shown in the table below. It illustrates that children under 18 living in families headed by single mothers with no spouse present are especially at risk of being poor. In 2010, 23 percent of children lived in female-headed families, but the table shows that children in such families accounted for 53.5 percent of all children.

Lack of Support from Government

Support for youth from government agencies is relatively low, especially when compared to that given to the elderly. In 2011, the share of the federal budget allocated to children was 10.4 percent. In contrast, 41 percent was allocated to the elderly. Public spending per child on federal and state programs averaged $11,300 during the course of a year. For seniors, it was $24,800 per person.

The political constituency for children is relatively weak. Obviously, they cannot vote and a child’s only source of influence is parents acting on their behalf. However, even parental priorities are likely to be divided between their children and the elderly, because it is likely that most families will have more surviving parents than children under age 18.

The adversarial political climate that emerged in the early years of the new millennium appears to be emphasizing self-interest, rather than altruism and collective interest. This suggests that empty-nester and senior-age cohorts, which are the fastest growing sectors of the population and also its most prolific voters, are unlikely to be supportive of increased spending on children because they receive no benefits from it.

In addition to age demographic self-interest, two other factors have been suggested as having some influence in the lack of support for government expenditures on children. First, reliable contraception gives people a high degree of control over whether they have children. Since children are often now the result of a private decision rather than of chance, some people have argued that parents should bear the costs of child rearing.

A second factor is that disproportionate numbers of poor children are from minority groups with whom some in the majority may have trouble identifying. Thus, of the 13.5 million children living in households below the federal poverty level, only 17 percent of them are white.

Why Restoring Full Youth Discounts Matters

The data presented in the previous section show there is a relatively large proportion of children from economically disadvantaged households. There are two rationales for supporting substantial discounts for children. First, some argue that leisure literacy is as important to a satisfying life as reading, writing and numerical literacy. It is contended that the absence of such skills in some cases will lead to deviant behavior that inflicts greater costs on society.

A further rationale stems from a consistent finding that, for the most part, people’s leisure interests and skills are established by the time they leave high school or college. Hence, by investing in youth through giving them meaningful discounts, park and recreation agencies are nurturing their future clienteles.

Meaningful Discounts, But Not Free

Among agencies that have maintained substantial discounts for youth, debate often shifts to the issue of whether they should be admitted free of charge. There are strong arguments against this. Children are likely to require more careful supervision and inflict more damage on a facility than adults, so the costs associated with servicing them often are greater. Further, children’s use of a service is likely to be contingent on their parents’, rather than their own, ability to pay. It is argued that if parents are not prepared to demonstrate their support by at least partially offsetting a program’s costs, it is unreasonable of them to expect people without children in the program to recognize it as worthy of subsidy through the tax system.

It is sometimes suggested that because society fully subsidizes other types of education through the public school system, then youth recreation programs that contribute toward leisure literacy also should be offered for free and fully subsidized. This analogy has two weaknesses. First, whereas all children are required to participate in education offered by the schools, only a select group of children elect to participate in programs offered by a recreation department. If only a select group of children receive benefits, it is difficult to make the case that they should be fully tax-supported by other citizens.

The inequity becomes even more pronounced if the select group are from middle- or high-income families rather than from low-income families, which is often the case in activities such as Little League, soccer, swimming and softball. These programs are usually subsidized by property sales taxes. In those situations, poor people are being required to subsidize a program even though their children do not benefit from it. These taxes are regressive and hurt poor people most.

A second weakness with the education analogy is that many schools already offer basic instruction in the recreation activities, and many of the programs offered by the recreation department are for more advanced practice of those skills and competitive opportunities.

Concluding Comments

In recent decades the norm among park and recreation agencies has been to yield to the pressures to generate more revenue by reducing both the age of eligibility for discounts and their magnitude. The author believes a strong case can be made for returning to the “half-price” norm of yesteryear and for restoring the age-18 qualification.

John Crompton, Ph.D., is a University Distinguished Professor, Regents Professor and Presidential Professor for Teaching Excellence in the Department of Recreation, Park and Tourism Sciences at Texas A&M University.